When you’re a first-time parent, you’re on a steep learning curve. There’s so much to learn and your to-do list never seems to end.

With healthcare costs rising, insurance protection is a key area for soon-to-be parents to look into, particularly if you tend to be a worrywart, or have some family history of complicated pregnancies. Such plans can offer protection, peace of mind, and for investment-linked products, even wealth accumulation.

Maternity protection plans cover two key aspects of pregnancy: pregnancy complications such as amniotic fluid embolism, miscarriage and pre-eclampsia, and congenital illnesses such as cerebral palsy, cleft palate, and Down’s Syndrome. If any of the covered complications arise, the one-time pay-out ranges from $5,000 to $12,000 depending on the type and length of plan.

Today, there are many different types of maternity plans on offer, and the information can get quite complicated. But not to worry – we’ve done the research for you. So here is the lowdown on the different plans currently available in the market.

Figures in Singapore dollars unless otherwise noted.

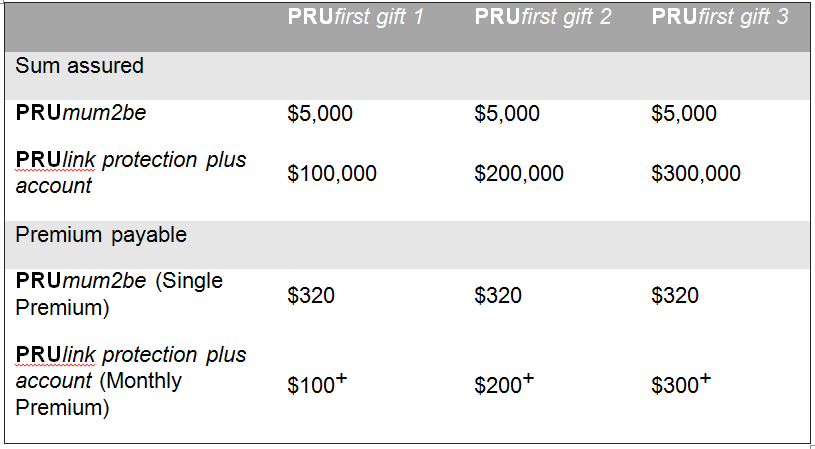

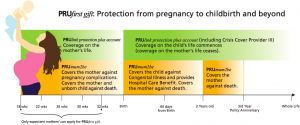

1. PRUfirst gift

In a nutshell:

* Two plans in one, namely PRUmum2be and PRUlink protection plus account. The pregnancy coverage plan converts into a whole life investment-linked policy for the child at birth.

Suitable for:

* Those who are keen on securing an investment-linked whole life plan for your child from day one.

Key features:

* Coverage from as early as 18 weeks into pregnancy.

* Covers mother against seven pregnancy complications, as well as death, terminal illness and disability before childbirth. The pregnancy complications benefit is $5,000 upon diagnosis.

* Covers new-born against 17 congenital illnesses, as well as death, disability, terminal illness and critical illness. The congenital illness benefit is $5,000 upon diagnosis.

* Offers selected hospital care benefits of $100 a day up to a life-time limit of $2,500 to the new-born. This terminates once the claim limit is reached or when the child is two years old, whichever is earlier.

* Offers critical illness coverage and hospital benefits.

* Because it is an investment-linked plan, there is a possibility of reaping returns at the end of the term. However, do note that all investment-linked products carry a certain level of risk.

Note: Buying a life insurance policy is a long-term commitment so it is best to speak to your financial advisor before making a decision.

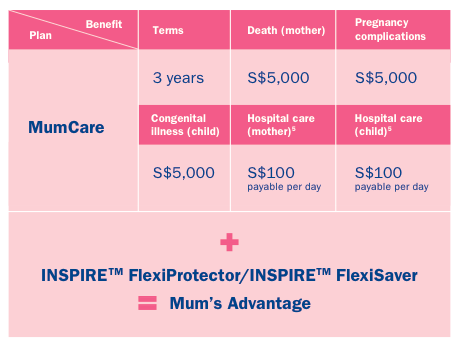

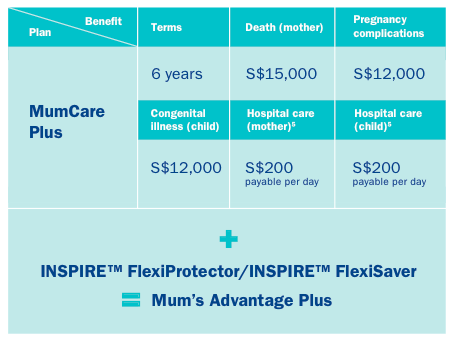

2. AXA Mum Advantage

In a nutshell:

* A combination of a maternity protection plan and investment-linked whole

life plan – Inspire FlexiProtector and Inspire FlexiSaver.

Suitable for:

* Those who are keen on securing an investment-linked whole life plan for their child from day one.

* Those who plan to conceive through IVF.

Key features:

* The expectant mother can be covered from as early as 16 weeks into pregnancy.

* The maternity plan has to be converted into a whole life plan for the child upon birth, for sum assured of up to $200,000.

* Covers 10 pregnancy complications and death of expectant mother. The death benefit due to pregnancy complications is $5,000 or $15,000, depending on the length of plan.

* Covers death of child and conditions related to 18 congenital diseases. The one-time pay-out for congenital diseases is $5,000 or $12,000 depending on the length of plan.

* Critical illness coverage and hospital benefits.

* Conceptions through IVF will be covered with extra premium loading.

* Because it is an investment-linked plan, there is a possibility of reaping returns at the end of the term. However, do note that all investment-linked products carry a certain level of risk.

Note: Buying a life insurance policy is a long-term commitment so do speak to your financial advisor before making a decision.

3. AIA Family First Baby

In a nutshell:

* Comprises both a regular premium investment-linked plan (AIA Family First Protect or AIA Family First Secure) and the AIA Family First Baby Cover rider.

Suitable for:

* Those who are keen on securing an investment-linked whole life plan for your child from day one.

* Those who plan to conceive through IVF.

Key features:

* Coverage from as early as 18 weeks into pregnancy.

* Expectant mums will enjoy coverage for eight pregnancy-related

conditions, hospital care and death.

* First plan in Singapore to cover pregnancies conceived through IVF.

* Your child will be covered for 18 congenital illnesses, incubation, admittance into intensive care and hospitalisation due to HFMD.

* Option of transferring the policy to your child without any medical check-ups, giving him or her lifelong coverage from birth up to the age of 100.

4. Great Eastern Flexi Maternity Cover

In a nutshell:

* A three-year maternity protection plan.

Suitable for:

* Those who prefer a straightforward maternity and child protection, without the commitment of a whole life plan.

* Those who prefer early coverage in the pregnancy.

Key features:

* Coverage from as early as 13 weeks of pregnancy.

* Coverage for child from birth until the end of the third-year policy term.

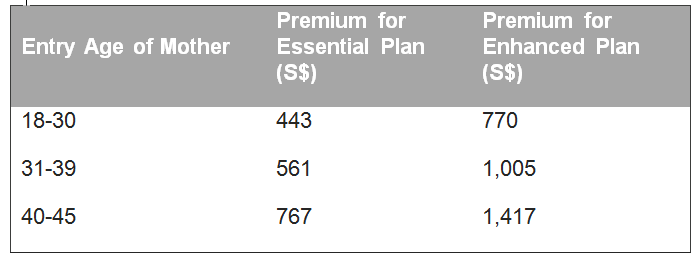

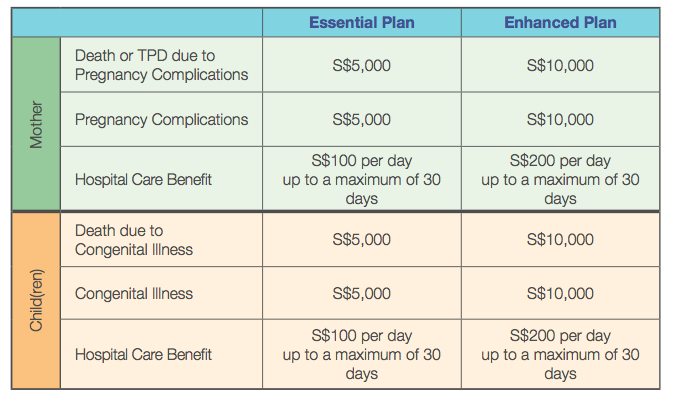

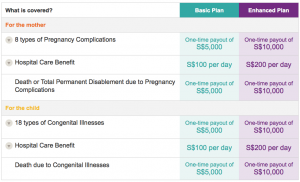

* Covers eight pregnancy complications and death or TPD for expectant mother. The death or TPD benefit due to pregnancy complications is $5,000 or $10,000, depending on the type of plan.

* Covers death and conditions related to 18 congenital diseases. The death benefit due to congenital diseases is $5,000 or $10,000 depending on the type of plan.

* Both mother and child can receive up to $200 daily hospital benefit.

5. AIA HealthShield Gold Max

Annual premium: $70–236, depending on age and type of plan.

In a nutshell:

* A Medisave-approved medical expense reimbursement plan that combines a MediShield Life component with additional private insurance coverage. The extra coverage gives you more benefits and a choice to stay in private hospitals or Class A/B1 wards in public hospitals.

Suitable for:

* Those who have not purchased an integrated shield plan for themselves.

* Those who are not pregnant yet, as there is a 10-month waiting period.

Key features:

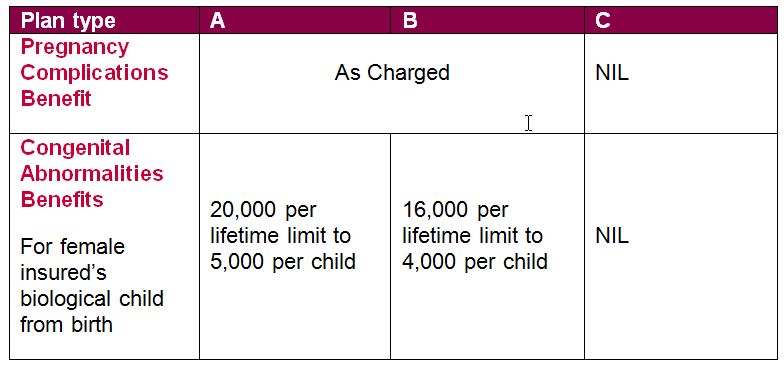

* Provides additional coverage to female assured’s children. If you choose the Gold Max A or B Plan, you are covered for seven pregnancy complications, on an as-charged basis.

* Your child is covered for congenital abnormalities for the first two years. The benefit goes up to $20,000 per lifetime, limited to $5,000 per child.

Note: There is a waiting period of 10 months from the inception date of your policy, so it’s best to get it even before you commence family planning.

6. OCBC MaxMaternity Care

In a nutshell:

* A maternity protection plan that offers the option to upgrade to an integrated shield plan for your child.

Suitable for:

* Those who would like maternity protection but also the option of having an integrated shield plan for your child.

* Those who prefer early coverage in the pregnancy.

Key features:

* Coverage from as early as 13 weeks into pregnancy.

* Covers mother against eight pregnancy complications, as well as death or TPD due to complications. The benefit is $5,000 or $10,000 depending on type of plan.

* Covers new-born against 18 congenital illnesses, as well as death, due to congenital illness. The benefit is $5,000 or $10,000 depending on type of plan.

* Both mother and child are entitled to hospital care benefits.

Note: Only available for OCBC customers.

7. Tokio Marine International Expatriate Cover

In a nutshell:

* An international medical insurance plan that provides extensive coverage for expats on overseas assignments.

Suitable for:

* Expats who are frequent travellers.

Key features:

* Pay for the level of healthcare coverage you want, hospitalisation benefits are covered at 100 per cent.

* Maximum annual limit for in and outpatient treatments up to US$4,500,000 per person, per year.

* Includes maternity, dental, and vision coverage.

* Cancer treatment is covered.

* Pre-existing and chronic conditions are covered, following acceptance of condition.

* Choose your area of coverage and benefit from direct billing agreements

and tariff arrangements for both in and outpatient treatments within large medical provider networks in 166 countries around the world.

* Discounts for children: 10 per cent for your second child, and 20 per cent for your third child onwards.

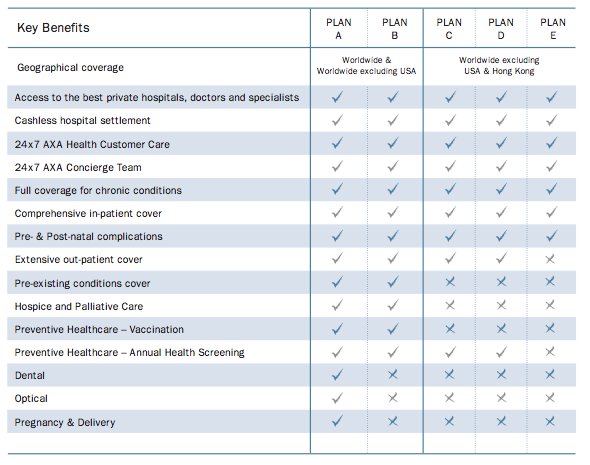

8. AXA Global Care Health Plan

In a nutshell:

* An international medical insurance plan that offers worldwide coverage for hospitalisation, outpatient treatments, maternity expenses, vaccinations, dental, optical expenses and beyond.

Suitable for:

* Globetrotters who want access to the best medical care anywhere in the world.

Key features:

* Choice of worldwide/worldwide excluding US/worldwide and Hong Kong cover plans.

* No upfront out-of-pocket medical expenses for hospitalisation.